When searching online for shepherds hut insurance, you will find there is an array of options to insure your hut, as it’s not so uncommon anymore. Meaning now you can purchase your perfect shepherds hut with knowledge that you’re hut is fully insured.

Certain insurers could cover the Shepherds hut like any other out-building such as greenhouses or annexes, including it as part of the house insurance, so we do recommend checking with your current insurance provider regarding this. However, if the Shepherds hut is separate to your home i.e. in a remote field or wood, then it is likely you will need to seek out specialist insurance cover, which is not hard to come by.

Nowadays, there are many specialist insurers who have started to branch out from insuring similar structures such as beach huts and glamping pods. Whilst there may be an increased premium which reflects the remoteness of the Shepherds hut, it is a price worth paying for the peace of mind that your special place is protected appropriately.

With a vast selection of air B&B and glamping sites now existing, insurance companies will usually have policies for both domestic and commercial use. A busy glamping shepherd’s hut would benefit from loss of earnings cover whilst any repairs or maintenance are carried out. This means that if the hut is ever unfit to stay in and out of use for some time you are covered and will not lose money from the inactivity.

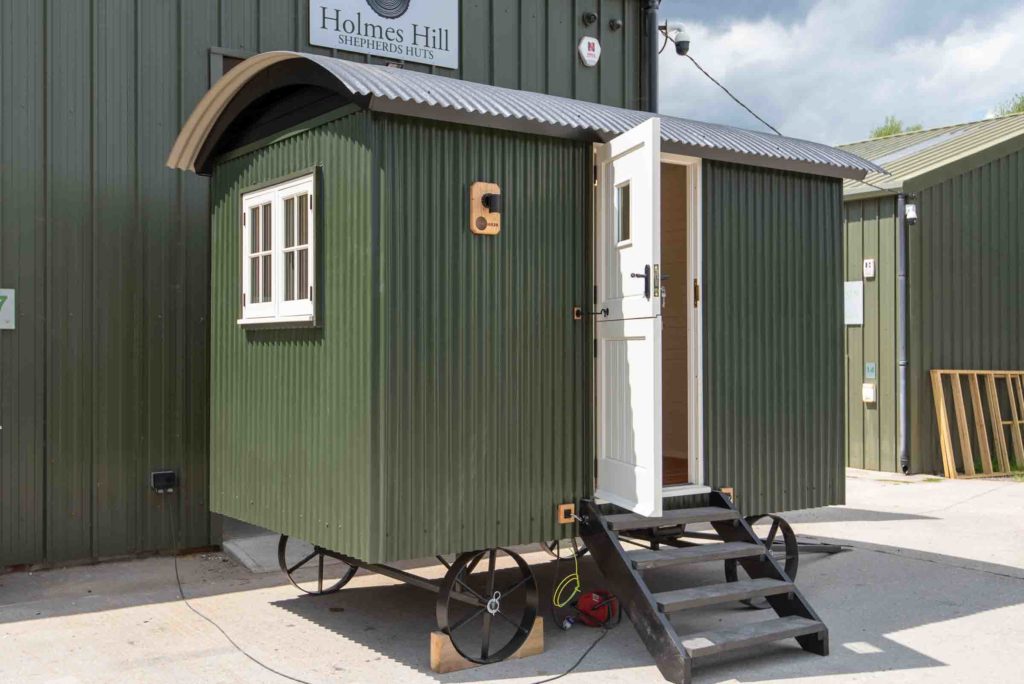

Fortunately, a shepherd’s hut is a big thing to load up and move, and access is often not as straight forward as it seems so the theft of an entire shepherds hut is unlikely. You may be asked by the insurance company how the hut is to be secured and there are a few methods for this: there are some hidden ways that the steering can be locked up; chaining a hut down to a concrete pad, a motorbike lock works well for this as the U shape will slide through a wheel spoke and around the axle bracket.

Alarm systems are also a good option but usually require internet access. However, there are some that do not need Wi-Fi but they tend to be more expensive. A security camera, and a small warning sign to say a camera is in operation is always a great deterrent.

How much does shepherds hut insurance cost?

There are a lot of factors that influence the price of your insurance premium. Your huts location, the structural quality of your hut and how secure your hut is can all impact your premium depending on the requirements of the insurance company. You also may need to factor in the value of the contents that are stored in your hut.

After speaking to some of our past customers regarding there huts and insurance, we have discovered that the insurance on a hut is far less then you would expect. For our smaller hut, the MCF 2, with £2,500 in contents cover and let out cover you are looking at roughly £180 a year and £17.87 a month with ‘Insure My Hut’. For our medium sized hut, the MCF 3, with £2,500 in contents cover and let out cover you are looking at approximately £253.04 a year and £24.92 a month with ‘Insure My Hut’. While for our larger huts, the MCF 4 and 5, with £2,500 in contents cover and let out cover you are looking at £323.40 a year and £31.72 a month with ;Insure My Hut’. These are quotes are just a rough guidance based on what our previous customers pay. ‘Insure My Hut’ is an easy to use shepherds hut insurer and we would advise you to take a look at there site and pop in your details for them to give you a more accurate quote.